A new world order

In the world of crypto, few figures have shaped its philosophical and technical trajectory as deeply as Vitalik Buterin, the co-founder of Ethereum. Beyond the whitepaper that birthed the world’s most programmable blockchain, Vitalik’s prolific blog output over the years has become a canon for developers, economists, and visionaries in the decentralized ecosystem.

For builders—especially those designing agent platforms, decentralized governance models, or crypto-powered coordination systems—these writings form a strategic blueprint. Build systems that are not only redundant in infrastructure but also politically and logically anti-fragile. Consider multisig governance, on-chain voting, and modular designs.

Total Value Locked (TVL) on Ethereum stands at $61.3 billion, dwarfing competitors—Ethereum holds ~45% of DeFi capital versus Solana’s ~5% (source).

Liquid staking (LST) on Ethereum locks 13.7 million ETH (~$34.4B).

ETH chain records ~$676K/day in fees and nearly $1 billion in 24-hour DEX volume (source).

See Vitalik’s recent blogs:

The near and mid-term future of improving Ethereum

Possible futures of Ethereum, Part 2

This scope matters.

Defi hatched

Enabling bold scaling ideas and ecosystem coordination requires such scale. It’s the bedrock on which Vitalik’s decentralization blueprint stands.

These numbers matter not as vanity metrics but as hard evidence: much of what Vitalik Buterin proposes in his blog writings—modular scaling, credible neutrality, permissionless governance—depends on Ethereum sustaining this role as the settlement and security layer for global crypto coordination. When Vitalik speaks about “The Meaning of Decentralization,” he doesn’t just refer to network architecture but to the political and epistemic dimensions of control: who defines protocol values, who updates client software, and who can contest outcomes. That meaning only gains traction when backed by thousands of actively verifying nodes, diverse client implementations, and real capital at stake.

Projects like Uniswap and other DEXs didn’t just emerge spontaneously—they were incubated in a unique intersection of open research, early crypto capital, and public infrastructure built on Ethereum. Understanding how they were hatched and funded reveals the mechanics of permissionless innovation, the catalytic role of public goods, and the quiet but powerful function of narrative leverage.

Uniswap began as a Reddit comment by Vitalik Buterin in 2016, suggesting the idea of an automated market maker (AMM) based on constant product formulas. Hayden Adams, an unemployed mechanical engineer at the time, decided to implement the idea in 2017, teaching himself Solidity and building the protocol’s early version. He received a $65,000 grant from the Ethereum Foundation in 2018, which helped him finish v1. Notably, Uniswap was one of the first examples of a successful public good funded entirely by EF grants before a token existed.

That original grant served a catalytic role, but the real growth came when Uniswap launched its protocol and began attracting liquidity. Paradigm, one of crypto’s leading VC firms, later invested in Uniswap Labs, helping it scale from a pure protocol to a company with developers, designers, and BD capacity. Paradigm reportedly led a $11M Series A round in 2020. Still, even as a venture-backed company, Uniswap the protocol has remained free and open—anyone can fork the contracts and build on top. This public nature was essential to its early network effects.

The larger ecosystem of DEXs followed similar but slightly varied paths. Curve Finance, another AMM optimized for stablecoin swaps, was started by Michael Egorov, a physicist and software engineer. Unlike Uniswap, Curve focused early on tokenomics, launching the CRV token with an intricate governance and staking model. It began with relatively low initial funding, but quickly grew via liquidity mining, incentivizing users to provide capital.

So, the DeFi ecosystem was not built with the permission of capital allocators—it emerged from a combination of ideas freely shared, public infrastructure like Ethereum and IPFS, and mechanisms like grants, liquidity mining, and retroactive public goods funding. What makes it novel is not just the technology, but how the capital formation and innovation pipeline itself was decentralized.

Philosophy and vision

When I look at his posts, I think this is common for geniuses - it’s not so much about being brilliant and solving whatever is at hand as it is a ton of hard work reading, writing (to clarify ideas) and brainstorm with others any thing that pops up in your head that may be relevant or applicable. There’s always something useful that comes out of it and eventually those things accumulate to what you, and others, iterate into working solutions.

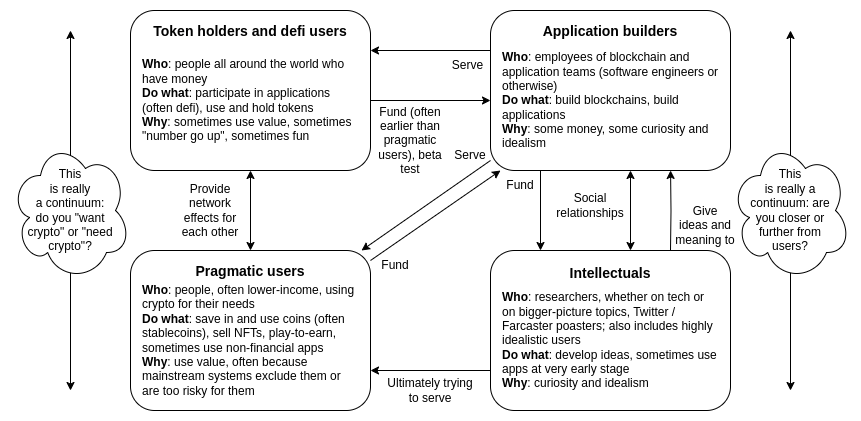

itself is an intentional 50/50 mix of idealism and “describing reality”. It’s intended to show four major constituencies of the ecosystem that can have a supportive and symbiotic relationship with each other. Many crypto institutions in practice are a mix of all four.

itself is an intentional 50/50 mix of idealism and “describing reality”. It’s intended to show four major constituencies of the ecosystem that can have a supportive and symbiotic relationship with each other. Many crypto institutions in practice are a mix of all four.

Each of the four parts has something key to offer to the machine as a whole:

Token holders and defi users contribute greatly to financing the whole thing, which has been key to getting technologies like consensus algorithms and zero-knowledge proofs to production quality.

Intellectuals provide the ideas to make sure that the space is actually doing something meaningful.

Builders bridge the gap and try to build applications that serve users and put the ideas into practice.

Pragmatic users are the people we are ultimately serving.

Remember that today’s blockchains are by definition developed by people with no prior blockchain experience. We all learned what we know from just digging into it.

So if you want to understand where blockchains are going, don’t start with whitepapers or Twitter threads. Look at Vitalik’s posts—but read them through the lens of what the data says. The writing is not a prediction. It’s a description of what’s already unfolding. If you’re building in Web3, the frontier is more than technical. It’s moral, economic, and social. Vitalik’s blog is not just a technical archive; it’s a guide to building a new kind of world. Read it not just as a reference—but as a call to action.

“The tools we build today encode the freedoms or limitations of tomorrow.” — V.B.

Further Reading: vitalik.ca

The following are Vitalik’s most influential and discussed blog posts, categorized by topic and with brief analysis, I highly recommend:

- The Meaning of Decentralization (2017)

Keywords: logical decentralization, political decentralization, architectural decentralization

-

Explained that decentralization is not just about node distribution, but also includes “who controls what” and “distribution of failure points”.

-

It has been cited countless times and is the philosophical starting point of the decentralized narrative of Web3.

-

Not a blog, but equally important. This is the Ethereum white paper he wrote, which proposes the vision of “world computer”.

-

If you haven’t read it, many core designs of Ethereum are difficult to understand.

-

A popular explanation of the design ideas of Ethereum sharding.

-

It is crucial to understand the evolution roadmap of Ethereum scalability.

-

In-depth analysis of the differences between DAO governance models and traditional companies.

-

DAO is more suitable in scenarios of “market externalities”, “high collaboration” and “high divergence”.

-

Promote the concept of the secondary mechanism of Radical Markets and conduct experiments in combination with Gitcoin.

-

Emphasize that the strong preferences of a minority can be expressed fairly to avoid violent voting by large households.

- Proposed “credible neutrality” (Credible Neutrality), applicable to chains, oracles, and protocol rules.

- One of the most recognized design philosophies in the crypto field.

- Systematically summarizes the pros and cons of optimistic rollups and zk rollups.

- Promoted Ethereum’s “modular blockchain” paradigm shift.

- Propose the scalability, security, and endgame of centralized game of future blockchain architecture.

- Assume that there is a super decentralized blockchain, but it must also rely on centralized building blocks (like sequencers).

- Deeply reveal the future direction of L1-L2.